Income Tax Payment Process

Here's Step by step guide to pay Income Tax

1. Visit income tax website at: https://www.incometax.gov.in/iec/foportal/

2. Under the "Quick Links" option, click on "e-Pay Tax" option.

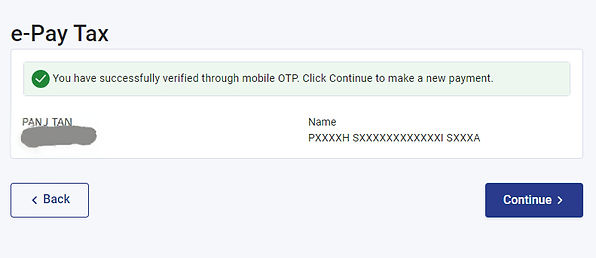

3. On next screen, enter the PAN and Mobile number. You will receive OTP on the mobile number mentioned in here.

4. Enter OTP on the next screen and click on Continue. Also click on continue on the next screen.

5. Select "Proceed" in the box titled "Income Tax".

6. Select "Assessment Year" and "Type of Payment" in the Next Screen

Select the correct Assessment Year. Once you make the selection, the relevant Financial Year is displayed for confirmation.

For example if you are paying tax for the financial year 2024-25, select assessment year as 2025-26 and so on. Please call in case of any doubt, because tax paid for wrong year will be of no use for filing the ITR.

Also ensure to select Correct Type of Payment.

-

For Paying taxes while filing ITR, please select "Self Assessment Tax (300)".

-

Select "Advance Tax (100)" for payment of Advance Tax.

7. Enter Tax amount in the next screen. You can enter the complete amount of tax including the surcharge, cess etc in single row viz. "Tax"

8. After you click "Continue", following preview screen will appear. Verify the particulars and click on "Continue".

9. in next screen, you can select the payment method like internet banking, Debit card etc.

10. Accept the Terms & Conditions and Click on "Submit to the Bank". You will be redirected to your bank's internet banking / card payment page for Payment.

11. Once you make the payment, you can download the receipt of tax paid.